An article by Chloé, added on 13 April 2023 5 min. reading

Almost three years have passed, punctuated by the global health crisis as well as economic difficulties. The easing, then the complete lifting of restrictive measures, coupled with the actions of hoteliers, will have enabled a considerable recovery in activity in 2022. After a favorable month of January, activity seems to be slowing down in February 2023, with a rate of 57,9% occupancy. Find below all the hotel figures for February 2023

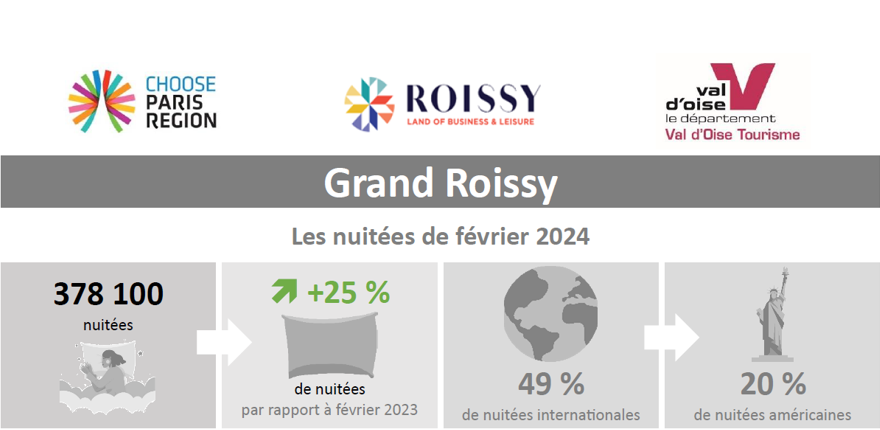

Key figures for Grand Roissy in February

Overall, all of the performance indicators are clearly improving, resulting in a significant increase in RevPAR in February 2023: +53,8% (i.e. €52,1 excluding tax). This observation translates into a recovery of €510 in turnover per room. The pricing strategies applied by Grand Roissy hoteliers will thus have contributed to reaching a RevPAR level in February 2023, 1,5 times higher than in 2022.

In addition, cumulatively for the first two months of 2023, the indicators are as follows: +20,6 points in occupancy rate compared to the cumulative January-February 2022; +19,9% average price, i.e. a gain of €15,6; and +81,5% RevPAR.

Holding MICE events and recovering air traffic has been beneficial

From February 7 to 9, 2023, the show Première Vision Paris was held within the Villepinte Exhibition Center, an unmissable event for international creative fashion professionals. For this new edition, 34 visitors (550% international and from 70 countries) gathered around 118 exhibitors. This corresponded to a growth in attendance of +1% compared to the July 246 edition (48 visitors), and +2022% compared to that of February 23 (277 visitors).

The growth in air traffic is benefiting the entire hotel portfolio of the Greater Roissy, with traffic of nearly 4,5 million passengers within Paris-Charles de Gaulle airport, i.e. a recovery of +52,8% compared to February 2022. The airport's activity thus continues with a level of recovery of 88,2% of traffic in February 2019.

Hotel performance by hotel category

The analysis in February 2023, by niche, highlights a stronger resilience of super-budget hotels (1* and 2*), which once again demonstrated its dynamism, with an occupancy rate of 74%, i.e. a gain of 14,5 points compared to February 2022. Budget hotels (3*) stands out by demonstrating the strongest momentum in the recovery of its occupancy across the entire hotel portfolio of the Greater Roissy, i.e. +20,8 points compared to February 2022. Nevertheless, the occupancy rate still remains low, at 49,6% in February 2023. The same is true for the upper slots, in particular mid-range hotels (4*) and tourist residences (5*), which posted an occupancy rate of 51,1% (i.e. a recovery of 14,5 points versus February 2022).

The activity of the Grand Roissy hotel portfolio continues with an overall average price up 13,9% compared to February of the previous period, ie a gain of nearly €11. Only budget hotels (3*) shows a slight deficit in its average price compared to February 2022 (-1,3%). Super-budget hotels (1* and 2*) recorded the highest average price increase (+€12), i.e. an average price excluding tax of €67,2, in February 2023. Mid-range hotels (4*) as well as tourist residences (5*) show an increase of +12% in their average price, thus reaching a level of €105,5 excluding tax.

Hotel figures for the three sectors of Grand Roissy

The analysis by sector highlights the particular difficulty of the Villepinte/Paris Nord 2 area in February 2023, as a result of the limited number of professional events and other major events. The additional leisure clientele remains lower, and is not enough to compensate for the withdrawal of business clientele.

- The Airport area stands out, posting the highest occupancy rate, ie 64,1%, benefiting from the recovery in international air traffic. In addition to recording the highest increase in the occupancy rate (+15,8 points), it also stands out through a markedly improved average price compared to the other two sectors, i.e. a gain of more than 11 € compared to February 2022. Despite an increase in its occupancy rate compared to February 2022 (+15,3 occupancy points), the latter still remains low with regard to the area.

- Despite a strong recovery in MICE activity compared to the previous year, it still seems to be suffering the consequences of the crisis and the difficulties that ensued. In February 2023, the Villepinte/Paris Nord 2 sector recorded an occupancy rate of 44,7%, the lowest of all Greater Roissy sectors.

To find the complete report for February 2023, click here.

This observatory was set up by the Grand Roissy Tourist Office in partnership with MKG.